estate tax change proposals 2021

The proposal seeks to accelerate that reduction. The proposed legislation would cause the increased exemption to expire at the end of 2021 instead of 2025.

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

So while a tax change is certainly possible its not at all certain.

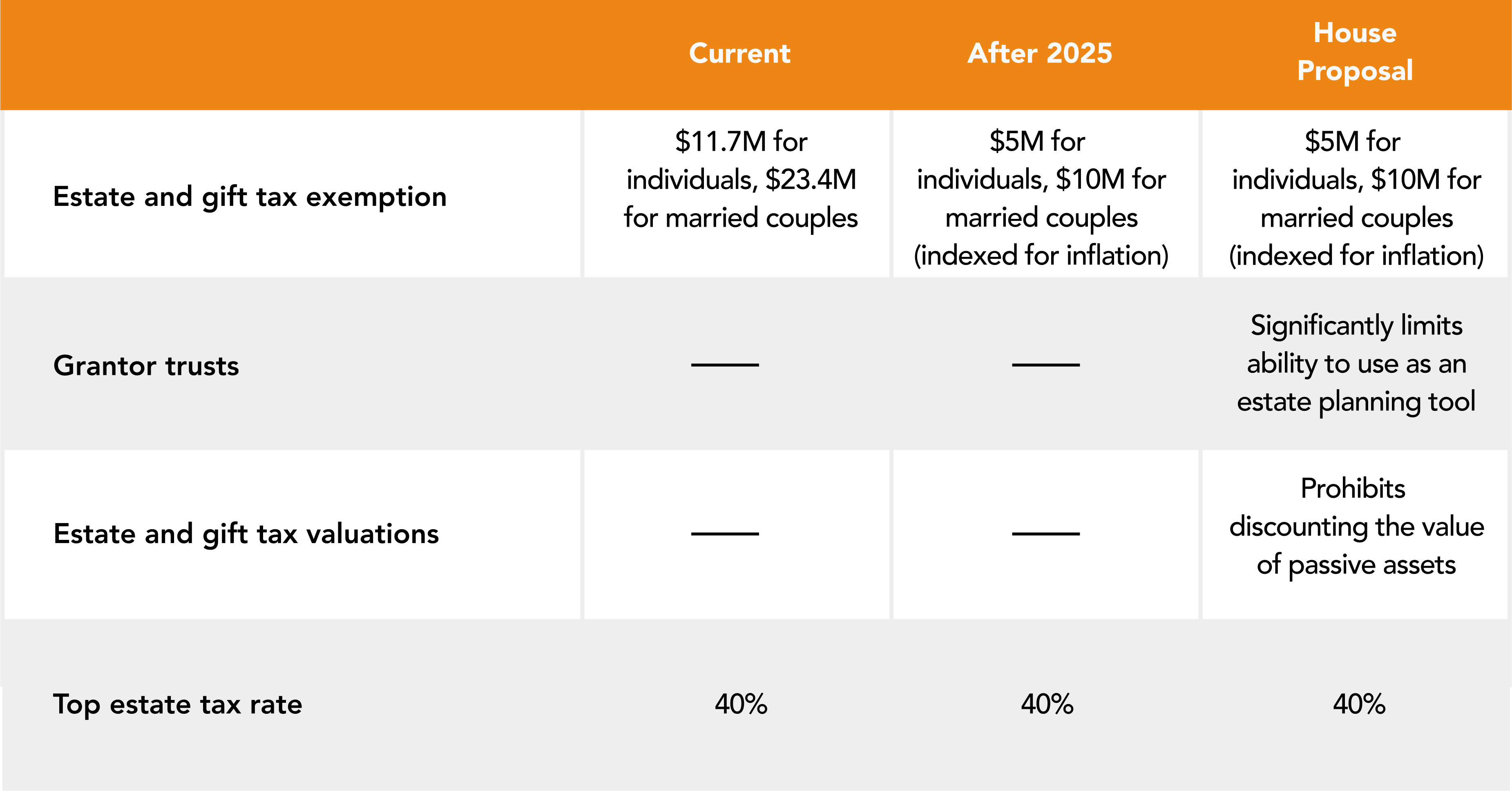

. This means that someone could leave an inheritance. Thankfully under the current proposal the estate tax remains at a flat rate of 40. This Alert focuses on the changes that directly impact common estate planning strategies.

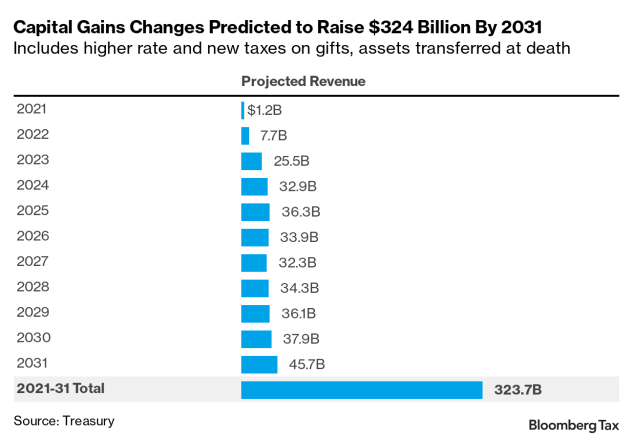

For this reason individuals may want to consider using any remaining gift tax exemption prior to the end of the 2021. The Township tax rate had no increase in 2021 2020 and 2019 after having been lowered. If such proposal is adopted the resulting federal gift and estate tax exemption would reduce to just over 6 million as of.

For the last 20 years the. For fourth year in a row Piscataway Township has a 128 percent lower municipal tax rate. September 2 2021.

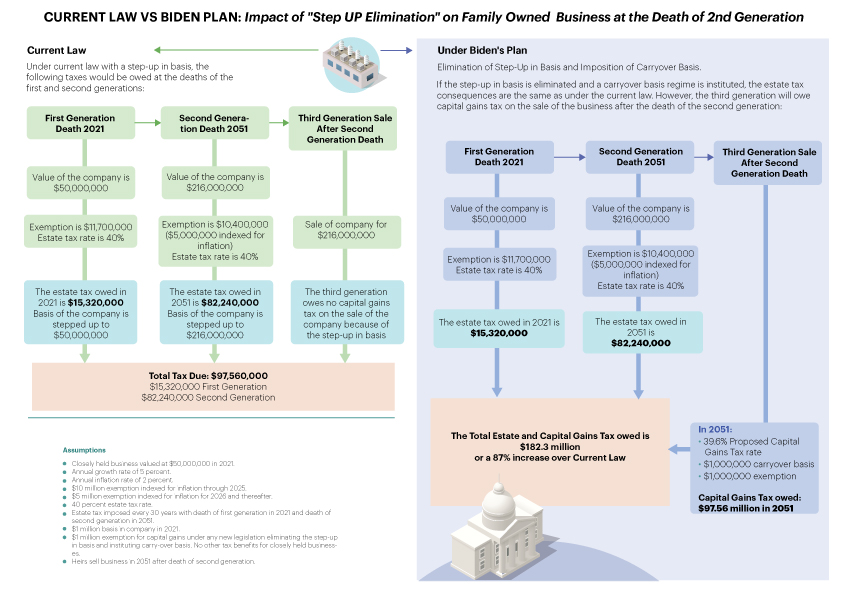

It is important to note that while certain changes in the Van Hollen proposal were drafted to apply retroactively to January 1 2021 neither the elimination of the step up in basis. The 2021 exemption is 117M and half of that would be 585M. Increase in Estate Gift Taxes.

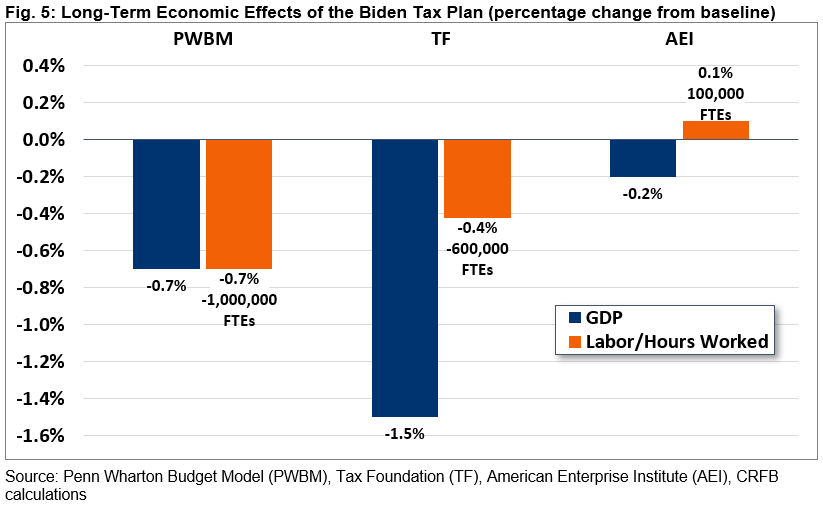

The tax proposal includes changes to the income tax brackets. The federal estate tax exemption is currently 117 million and the New York estate tax exemption is currently approximately 59 million adjusted for inflation. The House Ways and Means Committee released tax proposals to raise revenue on September 13 2021 which included notable changes to income tax and estate and gift tax.

455 Hoes Lane Piscataway NJ 08854 Phone. A recent proposal by Senators Sanders I-VT and Whitehouse D-RI For the 995 Act would dramatically alter the Estate. The new proposed system would reduce the number of brackets from 7 to 4 and raise the maximum income.

This year has brought many proposals to Congress that would dramatically change the tax implications for many farm businesses. Under current laws theres a 40 transfer tax on estates worth more than 1158 million. Proposed Build Back Better Act.

Proposals to decrease lifetime gifting allowance to as low as 1000000. Reducing the estate and gift tax exemption to 6020000. THE ASSESSING OFFICE IS OPEN MONDAY - FRIDAY BETWEEN 830 AM 430 PM Office Closed Between 1220 PM - 130 PM For Lunch CONTACT INFORMATION.

Staff accountant Norbert Jurkiewicz. Estate Tax Change Proposals 2021. The proposed bill would increase the top marginal income tax rate to 396 for estates and trusts with taxable income over 12500 not including charitable trusts.

This article is original content written by local Manchester CT CPA firm Borgida Company PC.

Estate Tax Current Law 2026 Biden Tax Proposal

Understanding Joe Biden S 2020 Tax Plan Committee For A Responsible Federal Budget

Are Major Tax Changes Ahead K T Williams Law

How Much Tax Will You Pay With Biden S Tax Plan Family Enterprise Usa

Big Tax Hikes Could Lie Ahead Adviceperiod

![]()

Death Taxes Real Estate Warrington

Estate And Gift Taxes 2021 2022 What S New This Year And What You Need To Know Wsj

Proposed Impact Of The American Families Plan Tax Proposal Fein Such Kahn Shepard

How Do State Estate And Inheritance Taxes Work Tax Policy Center

What The Proposed Tax Plan Means For Commercial Real Estate Voit Real Estate Services

Effect On Family Farms Of Changing Capital Gains Taxation At Death Morning Ag Clips

How Do The Estate Gift And Generation Skipping Transfer Taxes Work Tax Policy Center

Biden Corporate Tax Increase Details Analysis Tax Foundation

Proposed Changes To Estate Taxes Threaten Farmers And Ranchers Morning Ag Clips

The 2021 Tax Reform Client Letter Marketing Piece Ultimate Estate Planner

Unprecedented Changes Proposed To Gift And Estate Tax Laws Barnes Thornburg

Tax Pros Perplexed By Scope Of Biden S Capital Gains Overhaul

Proposed Federal Tax Law Changes Affecting Estate Planning Davis Wright Tremaine

Understanding Joe Biden S 2020 Tax Plan Committee For A Responsible Federal Budget